The Ashcroft Capital lawsuit is a legal case that sparked agitation among 12 accredited investors over inflated returns. It is a legal battle that is spinning across this specific syndication of real estate. Now, a question definitely comes to your mind about exactly what Ashcroft Capital truly represents.

Understanding the Ashcroft Capital is fundamental before digging much more deeply into the lawsuit. Ashcroft Capital is a multifamily apartment syndication cofounded by the joint cooperation of Frank Roessler and Joe Fairless in 2015. Legal controversies sprang up in early 2023, eroding the trust of investors in Ashcroft Capital. To understand the actual happening on February 12, 2025 lets catch and continue until the end.

What is Ashcroft Capital?

Ashcroft Capital is a real estate investment company delivering expert offerings in property management, construction, and asset management services. Apartment syndication and investing in real estate projects brought the firm into the limelight.

Background briefing on the rise of Ashcroft Capital

Kudos to Frank Roessler and Joe Fairless for establishing multifamily apartment syndication that became a trustworthy name in the real estate sector. The firm with $2 billion in assets operates across Florida, Texas & Georgia. Ashcroft Capital is a name in syndication excellence gain ground due to podcasting educational content and also some investment guides on YouTube.

The image shown above exemplifies the Ashcroft Capital webpage, a multifamily real estate investment firm.

Ashcroft Capital Lawsuit Case 2025

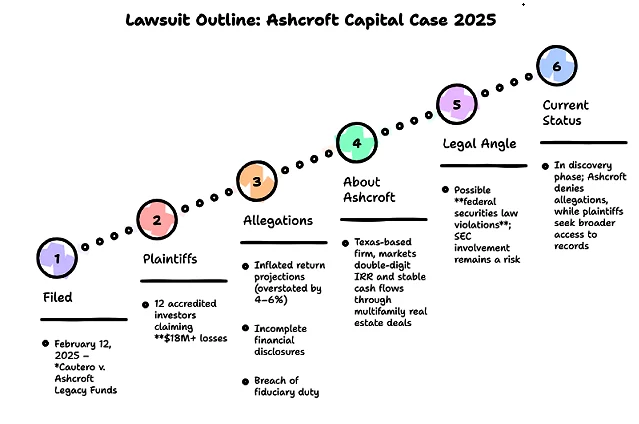

Formally acknowledged “Cautero v. Ashcroft Legacy Funds” was officially submitted as an Ashcroft Capital lawsuit on February 12, 2025, sharp. The investors had faced a severe blow due to $18 million losses that directly caused disgruntlement among “12 accredited investors”.

The investors’ response to the allegations revealed disclosure deficiency, an inflated projection of return, and a fiduciary duty breach that completely eroded their trust. Federal violations of the security law ignited hostility among investors altogether. Lawsuit Case 2025 against Ashcroft Capital was entirely denied by them, citing this as completely baseless.

Timeline of the Ashcroft Capital-Backdrop stage behind the lawsuit

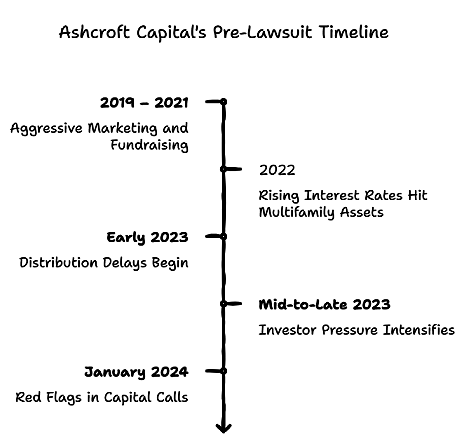

The Ashcroft Capital lawsuit did not happen overnight. The issue intensified gradually from dissatisfaction, communication gaps and last but not least due to messed financial expectation fulfillment. Unfolding the timeline of Ashcroft Capital makes it easily understandable for you. Let’s catch it below.

✅ Aggressive Marketing (2019–2021): The behaviour of aggressive marketing led by Ashcroft Capital attracted nationwide investors to go for it. Leveraging legacy fund acts as a backdrop for opportunity creation with quarterly distributions & 15% Internal Rate of Return (IRR).

✅ Exponential Rise of Interest Rates (2022): The portfolio of Ashcroft Capital started to fall under pressure while federal reserve hike the rate of interest. The multifamily asset was hard hit due to the rise in interest rates. Renovation took longer than expected, while the rising rental demand caused the occupancy rate to fall, which was projected earlier.

✅ Delaying distribution (Early 2023): Inconsistency was reported against the Ashcroft capital for taking longer than expected time with distribution. The widening gap between reality and the forecasted projection caused investors’ eyebrows to raise.

✅ Intensification of pressure from investors’ end (Late 2023): Lack of transparency, as well as unrealistic updates, inundated the complaints by online forum investors against the multifamily apartment syndication.

✅ Red flags regarding capital call (January 2024): The call for capital led by Ashcroft Capital for investor selection to meet debt pressure and renovation costs sparked early warning. The capital call revealed that Ashcroft was underperforming. This somehow sets the backdrop for ashcroft capital lawsuit.

Allegations against the Ashcroft Capital Lawsuit 2025

Let’s have a look at key allegations against the Ashcroft Capital Lawsuit that are summarised below :

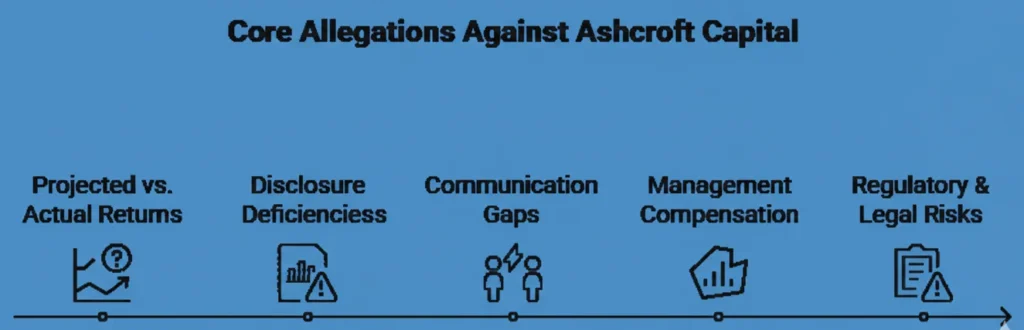

- Deviation between actual & projected returns: The investors consistently cited their disgruntlement with Ashcroft Capital giving inflated estimates for Internal Rate of Return (IRR). There has been a sharp deviation between actual & projected returns, which is actual misrepresentation. While the returns are flat or even negative, the projection for double-digit returns is showing an absolute mismatch.

- Disclosure deficiency: Renovation bottlenecks and a lack of third-party audits can also allegedly act as a barrier for investors to make smart decisions.

- Management compensation: Ashcroft management compensation from sponsor fees & asset management is somehow displaying as unfair means among investors.

- Communication gaps: Sometimes vague or more specifically gibberish quarterly updates showcase an optimsitic pictures which is actually underperforming. This communication gap with investors is eroding their trust in Ashcroft Capital.

Regulatory & legal risks: The Rule 10b-5, as enshrined in the Securities Exchange Act, is showing a sharp violation of making misleading statements. Hence, claims can arise if the law violation is substantiated further.

How does Ashcroft Capital defend the claims?

The Ashcroft Capital lawsuit came into light in early 2025. The disgruntlement against Ashcroft Capital is not an overnight incident that suddenly emerged over social media and online forums. Despite all the rumors and speculation surrounding it, Ashcroft Capital has publicly defended the claims made against it, citing that it is completely without merit and baseless.

How do investors react

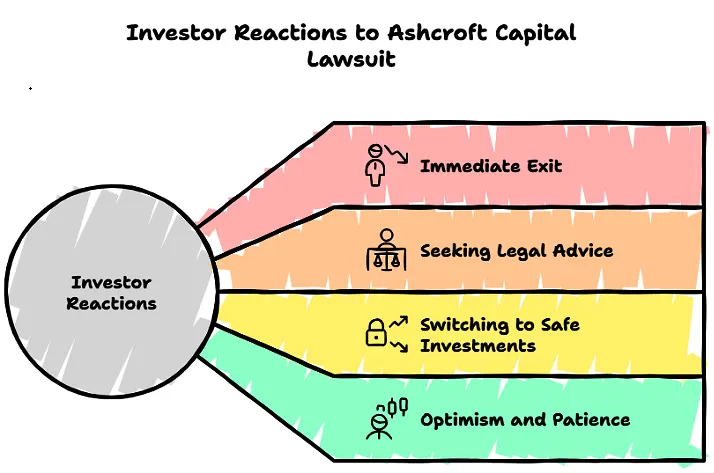

TheAshcroft Capital lawsuit has had a multifaceted ripple effect on investors. The panic is far-reaching and intensified among newer investors who are not very familiar with syndication risks. Below, I share a distinct response from the investors’ end to showcase how they react to the recent underperformance that led to a lawsuit against Ashcroft Capital.

👉 Frustrating enough to exit without delay: Many investors are becoming frustrated enough that they have no choice but to exit from this without any delay.

👉 Seeking advice and going for a legal consultation: Some react with patience, think it is judicious to go for real estate attorneys and Financial advisors to decide how to proceed further.

👉 Switching to regulated, minimal risk vehicles: Looking for a safety alternative, some investors reallocated their capital into liquid and minimal risk vehicles.

👉 Keep an optimistic attitude & patience: Seasoned investors are showing some degree of optimism & patience, both. They evaluated macroeconomic factors before blaming them for the recent underperformance crisis.

Final words

Ashcroft Capital lawsuit is not just a legal battle, but a sharp reminder that raising doubts about professional rigour and trust against the syndication of real estate. It does not matter what the end outcomeof the lawsuit is. Conversations among investment communities set newer benchmarks for making real estate-based judicious decisions for any syndication. It is an eye-opener for investors to take a pause and decide on making any real estate decision for the near future.