Running a business for a high-risk merchant account at highriskpay.com may seem intimidating for many users, as any wrong move acts as a trigger, causing the account to freeze and even to face a chargeback. Selecting an appropriate payment processor is invaluable for running a business in the high-risk segment.

This is why the high-risk Merchant Account at Highriskpay.com is standing out as a true gateway to meet business expectations. Here in the blog, you can get an insight into niche industries, benefits, challenges, operating costs, application procedure, and much more. Let’s catch up together for a complete overview of a high-risk merchant account at highriskpay.com.

What is a High-Risk Merchant Account at Highriskpay.com?

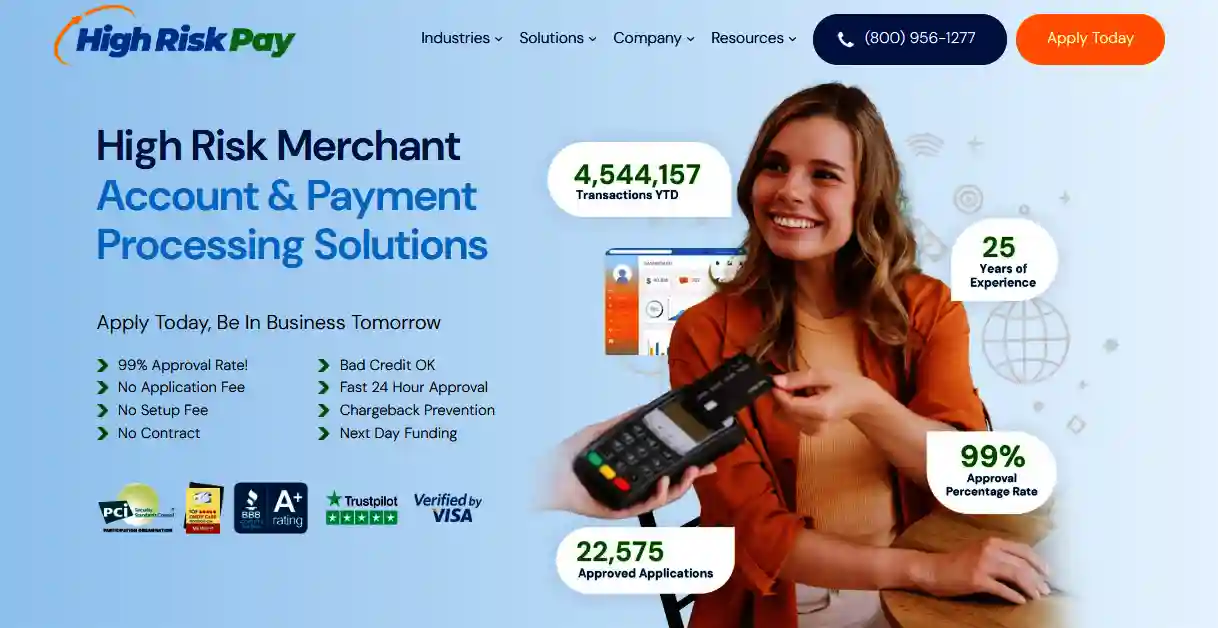

HighRiskPay.com is a boon for sensitive industries with higher chargeback and poor credit report details. Now I think you are pondering what exactly I mean to say by sensitive industries, right? Frankly speaking, Adult Content, Travel & Tourism, Gambling, E-Cigarettes, and Vaping are some of the categories that fall straight under the high-risk sensitive industry.

These businesses that have witnessed rejection from a conventional financial intermediary are going to “Highriskpay.com” to secure guaranteed higher approval and not face chargebacks. This is how HighRiskPay.com helps them in overcoming setbacks stemming from credit card payments and smoother transactions with finance, despite acknowledging their high-risk profile.

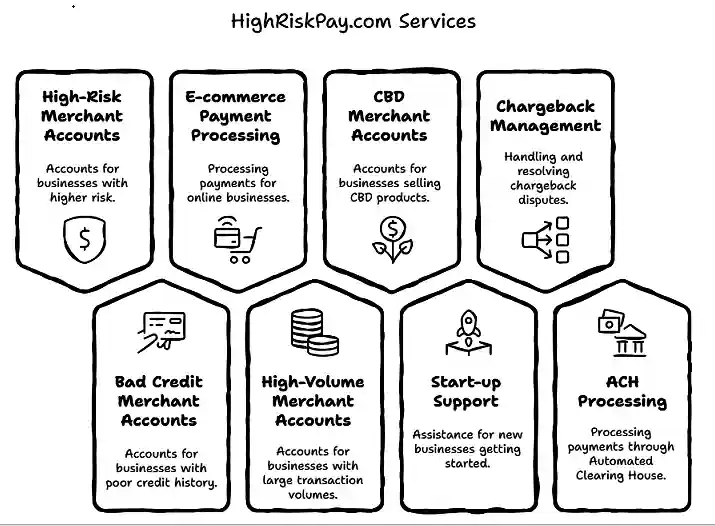

What service does HighRiskPay.com offer for High-Risk Businesses?

High risk merchant account at highriskpay.com are offering some top-notch service to businesses coming under high-risk industries that often face rejection from most other conventional financial intermediaries. The image shows the offered service led by HighRiskPay.com to high-risk businesses.

The high-risk merchants that are served by HighRiskPay.com include the following, as shown on the website of HighRiskPay.com.

Rationale behind the business requirement for High-Risk Merchant Accounts

Myriad reasons make a high-risk merchant account at highriskpay.com an ultimate destination for many individuals to go to the platform without a doubt. Check it out below that makes you understand the rationale behind the business requirement for high-risk merchant accounts.

Guaranteed higher approval assistance: HighRiskPay.com is guaranteeing Higher approval for assistance for higher risk business make it a point of attention among merchants to go for this impressive support. Unless or until any severe issue of credit is encountered, it promised 99% acceptance rate.

Fast Approval Process: It takes minimal time to get approval, mostly between 24 and 48 hours.

Free setup or no application fees: If anyone wants to go for free setup assistance without any investment in application fees, it is a judicious move that no one denies.

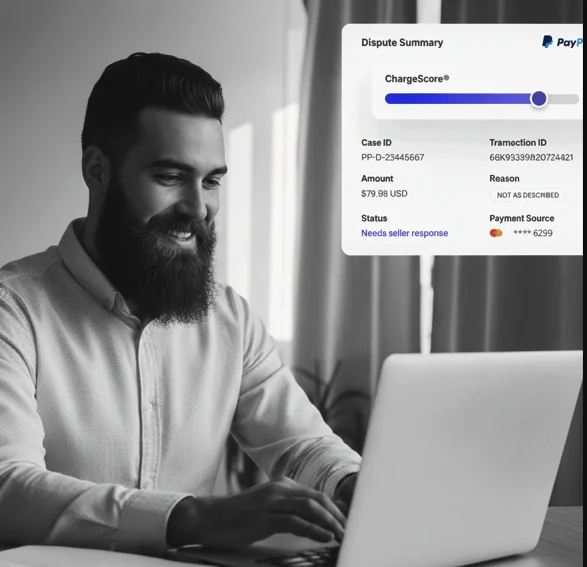

Prevention of chargebacks: Leveraging advanced tools by highriskpay.com helps to evade issues like chargebacks.

Promised next-day funding: It minimizes the need for a long wait, as funding assistance is prompt within the next few hours to be reflected in the receiver’s account.

Niche industries benefited

Adult content: Industries that deal with the publication of adult content through their websites. They are also covering the distinct needs of users who are looking for toys, clothing, services, and adult online dating.

E-Cigarettes and Vaping: Certain shops are engaged in satisfying the user demand by providing e-liquids, e-cigarettes, and vaping.

Subscription Services: Some membership sites offer Subscription Service solely based on user demand and charge recurring payment by billing.

Tourism: This sector assists with travel options via agencies & agents.

Gambling: Industries that deal with sports betting and online casinos.

High-Risk Merchant Account at HighRiskPay.com- Apply procedure

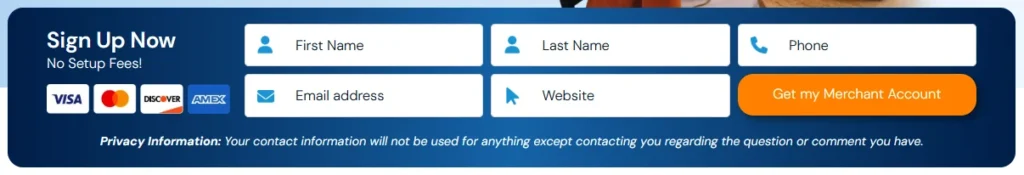

Applying for a High-Risk Merchant Account at HighRiskPay.com is a simple, straightforward, & easy process. So if you want to apply, you just need to follow the basic steps to start exploring and enjoy your kickstart journey with a High-Risk Merchant Account.

- Visit the official site of HighRiskPay.com and fill in your entire details, including your name, email address, and phone number.

- Now you have submission requirements for your other details that include verification documents, insurance proof, bank account details, and last but not least, a driver’s license.

- After successful sending of all your documents, DocuSign sends you a request to submit your signature. So you just need to review and sign it to complete the entire process of application submission.

So why wait? Go straight to the website and click on Apply Today.

Pros and Cons

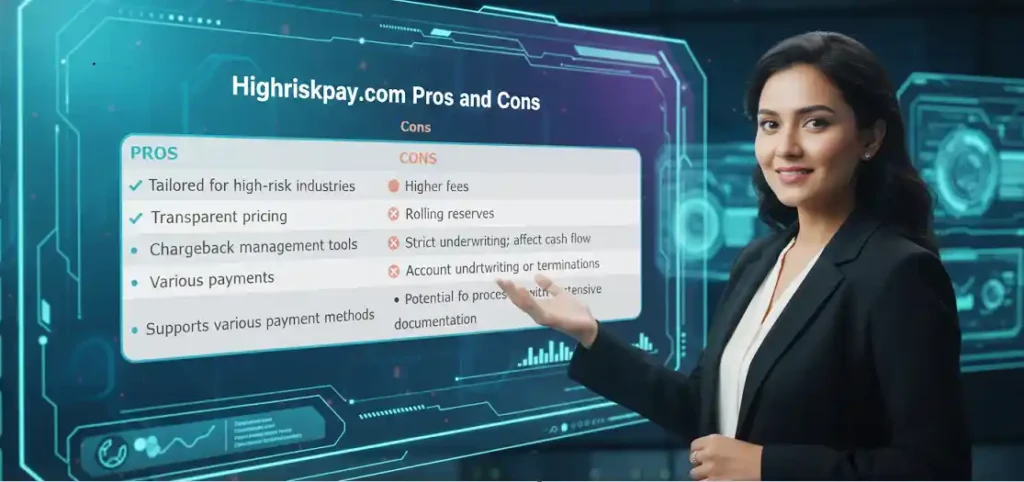

| Pros | Cons |

| Specialized Industry Focus: Services are custom-built specifically for high-risk business sectors. | Increased Costs: Processing fees tend to be higher for businesses in high-risk categories. |

| Clear Pricing Structure: Offers transparent rates without any unexpected or hidden charges. | Cash Flow Impact: The use of rolling reserves can restrict immediate access to funds. |

| Advanced Chargeback Protection: Provides powerful tools designed to manage and reduce chargebacks. | Rigorous Approval Process: Underwriting standards are more stringent for new account approvals. |

| Versatile Payment Options: Accommodates a wide variety of payment methods. | Demanding Onboarding: The registration process is detailed and requires extensive paperwork. |

What clients say about highriskpay.com

Here, I mention some user reviews of highriskpay.com, through the image from Trustpilot, to let you share what users truly feel about this platform.

Wrapping up

In a nutshell, if you’re truly concerned with high risk mechant account, then no need to start panicking. Everyone opts for a payment processor that proves reliable and trustworthy in the end, especially when dealing with high risk merchant account. Hence, highriskpay.com comes out as a breakthrough with minimal disruption, giving you a serene vibe and mindfulness with this online payment gateway.